Wealth in the United States can be summed up pretty easily; you’re either really rich, or really poor.

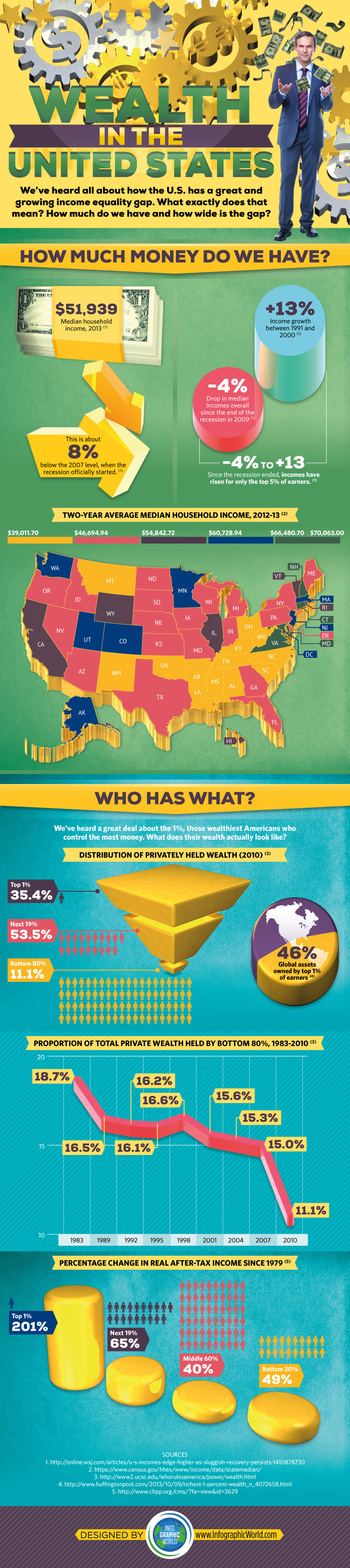

Since the recession ended back in 2009, incomes have barely increased, and only the top 5% of earners actually saw those increases. That not only helps widen the income gap, but paints a bleak picture for many employees seeking a raise or advancement at their jobs.

In 2013, the average median household income was just over $51K, but this is 8 percent less that it was when the recession officially started in 2007. Most households have yet to recover. With that being said, there are a few states where incomes are stable and sit well above the US average.

Residents in Virginia, Connecticut, Maryland and New Hampshire earn on average between $66K and $70K per year. Considering the cost of living in those states may be higher than others, the bump in income doesn’t necessarily translate into disposable resources.

When it comes to privately held wealth, most Americans are in the same boat. The top 1% own a whopping 35% of the private assets, while the bottom 80% or wage earners collectively own just over 11 percent.

This is an interesting look into wealth in United States, and poses a simple question; what can be done to help the bottom wage earners see an increase in their income and overall wealth? Although the question is simple, the solution is far from it. It’s the debate of the century, and no one seems to have any perfect answers.

Leave a Comment